Many organisations have now issued several years’ worth of disclosures. So is the Task Force on Climate-Related Financial Disclosures (TCFD) framework now considered “business as usual”?

According to risk leaders we surveyed, as part of a recent pulse check to better understand our members’ TCFD approaches, work is still ongoing to improve the TCFD reporting process.

But what is working well? Practitioners in our network have highlighted the most effective aspects of their existing process.

1. Establish clear accountabilities

One risk leader suggested that having clear ownership of TCFD within their HSE team is working well for their organisation. However, a range of inputs from around the business are typically required to develop a TCFD disclosure.

Accountability here not only relates to the person or team that owns the process, but other functions who contribute towards it.

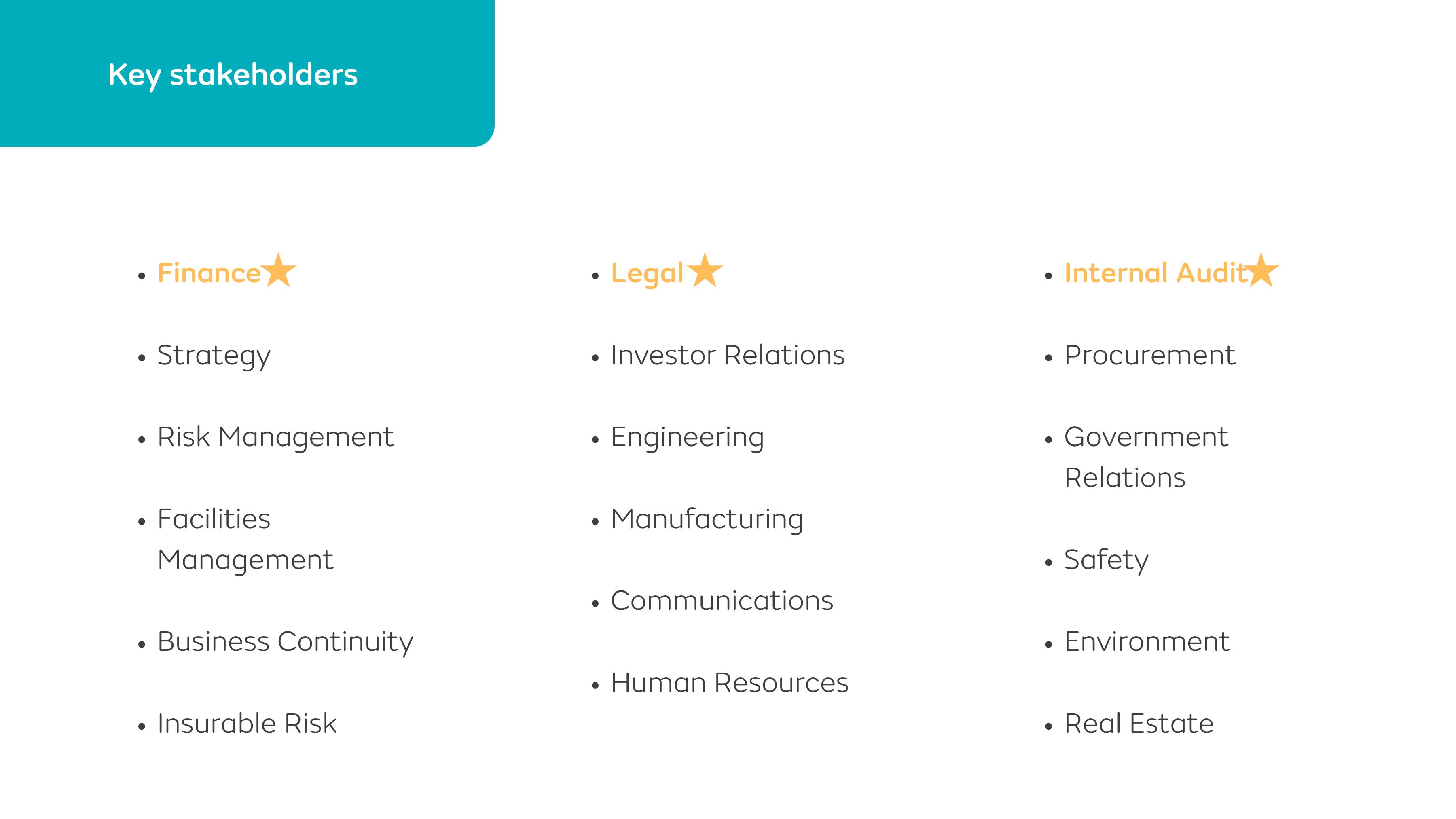

In a recent case study, a risk and sustainability leader shared a “stakeholder mapping” process they followed to decide which group-level teams should be involved. Three criteria were used to develop long and shortlists of responsible stakeholders:

- The knowledge, information or data they could provide;

- Their influence on the business; and

- How important it was, from a functional perspective, for them to be involved.

A wide range of potential stakeholders were listed (see graphic below). However, three teams stood out in particular, based on the above criteria.

2. Engage with external auditors early

“Early engagement with external auditors, and faster sign off of disclosures that doesn’t change dramatically year-on-year, has proven useful.”

Risk leader at a FTSE organisation

At a majority of organisations, external auditors are responsible for assuring TCFD disclosures, either solely or in partnership with Internal Audit. It’s crucial, then, to get them on board early.

External auditors can provide assurance on the information you’re using (e.g. for modelling) as you go along, and advise on the evidence that is likely to be needed by regulators or formal audits conducted for compliance purposes.

|

Where does this information come from? A Risk Leadership Network member wanted to benchmark their approach to challenges related to TCFD, such as assuring climate risk data, assigning ownership for disclosures, and reporting internally on TCFD. We followed this up by facilitating a series of 1-to-1 virtual meetings for the member, allowing them to dig deep on the approaches of relevant peers. |

Organisations need data to determine the impact of a range of environmental scenarios on the business. For example, what is the potential impact of increased temperatures on weather patterns? And how might this affect a large asset in a flood zone?

Some businesses will already be dealing with issues such as extreme weather and have the relevant data. However, even companies with a less direct stake in climate-affected markets may have internal data to draw on for TCFD.

So, how can you be sure the data you’re using can be trusted? And how do you ensure that the data covers all of your gaps?

Below, we’ve highlighted a selection of approaches risk leaders in our network are taking:

4. Integrate TCFD into annual report

“Integrating TCFD into our annual report, rather than publishing it as a separate document, has been effective.”

CRO, FTSE company

Risk leadership network member

According to data from our TCFD Reporting Comparison Tool, among FTSE100 companies:

- TCFD disclosure is found in the environment, sustainability and governance section at 51% of companies.

- 33% of companies include TCFD in the risk management section.

- 13% of companies report on TCFD in a separate document.

Our data shows that while issuing a separate TCFD report does correlate with a slightly increased focus on climate-related opportunities, targets and scenarios, just one of the 13 companies (8%) who report in this way include reference to financial impact.

It could be argued, then, that synergising annual reports and TCFD is a more efficient way to cover all bases.

How are your peers reporting on TCFD?Created in response to the requests of our members, the TCFD reporting comparison tool allows you to easily benchmark against listed companies’ approaches to climate risk disclosures. |

Where to next?

Risk leaders have highlighted what has worked well for them so far, but have also shared some of the adjustments they’re planning to make. These include:

- Encouraging more involvement and ownership from the Finance team.

- Implementing a tool to help record and report climate data more consistently.

- Shifting focus to the Corporate Sustainability Reporting Directive (CSRD), which will soon absorb TCFD for many companies.

Evidently, TCFD reporting will continue to evolve, particularly as the regulatory landscape undergoes changes that realign companies’ compliance requirements.

Would you like to be involved in the conversations our members are having about regulatory risks and challenges? We are supporting risk leaders as they prepare for legislative change, particularly in relation to CSRD and double materiality assessments.

To learn more about the targeted collaborations we’re facilitating around this topic, book an introductory call with our team.

Share this

Related posts you may be interested in

Levelling up climate risk reporting: our TCFD Reporting Comparison Tool

Top 10 principal/material risks of 2024